🧠 Understand the 🗽 American #Airline Sector 🛩️ Rally of Oct 2016

🧑🏫 Step-by-Step Explanation 🏫 of the successful 🏭 Sector Uptrend 📈 in the 🎩 Dow Airlines ✈️ Average (DJUSAR) and the North American Airline Sector during October 2016.

by Charles Adams

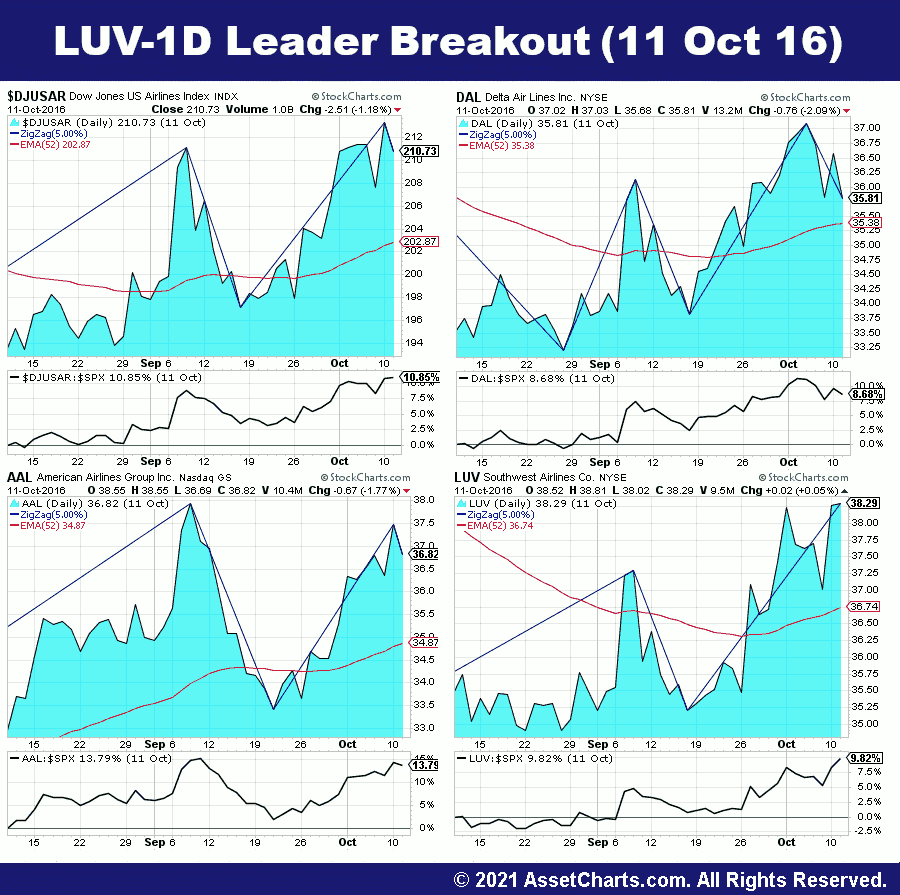

1) As It Happened: 🐤 Early-Bird Breakout 🎆 in LUV on 11th Oct 2016

Several research reports have illustrated the importance of sectors on the success of investment strategies [1]. Meanwhile, the airline sector represents a significant member of the transportation super-sector, alongside the kindred courier, marine, road and rail sectors [2]. Thus, price movements of the various stocks within the airlines sector are naturally highly correlated with each other, and show traditional lead-lag patterns which can be used to generate profits.

One such case occurred on 11th Oct 2016, when Southwest Airlines (LUV) exhibited an early-bird breakout by moving above its trading range while other stocks in the same sector were still stuck inside their narrow vertical price trading ranges:2) The 🏭 Sector Breakout 🎆 on 13th Oct 2016

This was followed by a successful sector breakout on 13th Oct 2016:3) 🏭 Sector Up-Trend 📈

The result was a profitable upmove over the next few weeks.📝 References 📃

- ^ McIntosh, Sector Strategist, p.31-32.

- ^ Pring, Active Asset Allocation, p.281, p.289.

📘 Bibliography 📗

|

McIntosh, Timothy J. 'The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment Returns'. 1st Edition. Hoboken (New Jersey): John Wiley & Sons, 2012. 226pp. ISBN: 978-1-118-17190-5. Borrow or Buy: [ amazon | biblio | worldcat | abe | isbnsearch | justbooks.co.uk | gettextbooks | goodreads | openlibrary | univ. manchester | librarything ]. Introductory work on sector rotation. |

|

Pring, Martin J. 'The Investor’s Guide to Active Asset Allocation: Using Intermarket Technical Analysis and ETFs to Trade the Markets'. 1st Edition. New York (NY): McGraw-Hill, 2006. 385pp. ISBN: 978-0-07-149159-4. Borrow or Buy: [ amazon | biblio | worldcat | abe | isbnsearch | justbooks.co.uk | gettextbooks | goodreads | openlibrary | univ. manchester | librarything ]. Advanced work on asset allocation and sector rotation. |

Fig.1: Sector Breakout in the Dow Airlines Quad.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.1: Sector Breakout in the Dow Airlines Quad.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.2: Sector Breakout in the Dow Airlines Quad.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.2: Sector Breakout in the Dow Airlines Quad.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.3: Another Breakout in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.3: Another Breakout in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.4: Up-Trend in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.4: Up-Trend in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.