👁️ Visualise the 🗽 American #Airline Sector 🛩️ Rally of Dec 2012

📊 Technical Analysis 📈 of the profitable 🏭 Sector Uptrend 📈 in the 🎩 Dow Airlines ✈️ Index (DJUSAR) and the North American Airline Sector during December 2012.

by Charles Adams

1) As It Happened: 🐤 Early-Bird Breakout 🎆 in LUV on 21st Nov 2012

Various academic studies have demonstrated that sectors form an increasingly important component of security returns [1]. Within the transportation super-sector, the airline sector represent an important constituent alongside the courier, marine, road and rail sectors [2]. As a logical result, returns across the various stocks within the airline sector are highly correlated and exhibit lead-lag relationships which can be exploited for substantial profit.

One such instance occurred during late November to early December 2012. Starting from 21st Nov 2012, Southwest Airlines (LUV) exhibited several breakouts from its two-month trading range while other stocks in the same sector remained trapped within narrow trading ranges (see Fig.1). These are referred to as "Early Bird Breakouts" in our proprietary AssetCharts.com Sector Rotation Methodology.

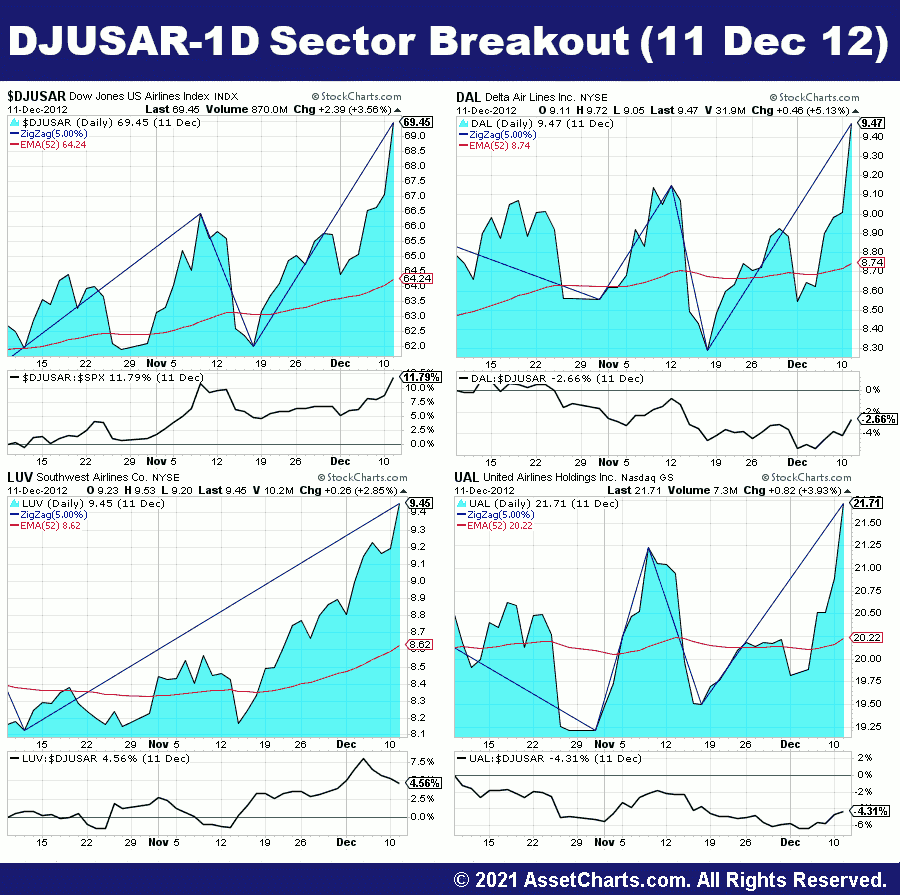

2) The 🏭 Sector Breakout 🎆 on 11th Dec 2012

These Early Bird Breakouts ocurring in Southwest Airlines were a harbinger of a colossal sectoral move. Thus, the entire airline sector literally exploded into a sector breakout on 11th Dec 2012:3) 🏭 Sector Up-Trend 📈 for a FULL YEAR!

The result was a profitable upmove over the next year! Many of these stocks almost doubled. This demonstrates the extreme power of the AssetCharts Sector Breakout Methodology. Fig.3: Up-Trend in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.3: Up-Trend in the Dow Airlines Sector.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

📝 References 📃

- ^ McIntosh, Sector Strategist, p.30-31.

- ^ Pring, Active Asset Allocation, p.281, p.289.

📘 Bibliography 📗

|

McIntosh, Timothy J. 'The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment Returns'. 1st Edition. Hoboken (New Jersey): John Wiley & Sons, 2012. 226pp. ISBN: 978-1-118-17190-5. Borrow or Buy: [ amazon | biblio | worldcat | abe | isbnsearch | justbooks.co.uk | gettextbooks | goodreads | openlibrary | univ. manchester | librarything ]. Introductory work on sector rotation. |

|

Pring, Martin J. 'The Investor’s Guide to Active Asset Allocation: Using Intermarket Technical Analysis and ETFs to Trade the Markets'. 1st Edition. New York (NY): McGraw-Hill, 2006. 385pp. ISBN: 978-0-07-149159-4. Borrow or Buy: [ amazon | biblio | worldcat | abe | isbnsearch | justbooks.co.uk | gettextbooks | goodreads | openlibrary | univ. manchester | librarything ]. Advanced work on asset allocation and sector rotation. |

Fig.1: Leader Breakout in Southwest Airlines (LUV) on 23rd November 2012.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.1: Leader Breakout in Southwest Airlines (LUV) on 23rd November 2012.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.2: Sector Breakout in the Dow Airlines Quad on 11th December 2012.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.

Fig.2: Sector Breakout in the Dow Airlines Quad on 11th December 2012.

Kindly Click to Enlarge the High-Quality Sector Rotation Chart.